‘We’re disappointed’ – Kumasi business owners react to 2023 budget, ask MPs to reject it

Ashanti Business Owners Association is urging parliament to reject the 2023 budget presented by the Finance Minister, Ken Ofori-Atta, saying it contains policies that are inimical to the survival of their businesses.

The traders expressed serious reservations about the tax policies contained in the Budget Statement. According to them, the increment in the Valued Added Tax (VAT) by 2.5 percent will increase the cost of doing business and further burden consumers who are already struggling to survive.

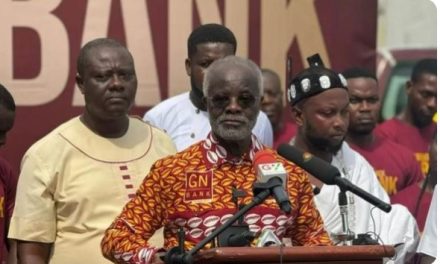

Charles Kusi Appiah-Kubi, the Executive Secretary of the Ashanti Business Owners Association said that they had expected that the government would be sensitive to the suffering of Ghanaians and introduce policies that are aimed at alleviating their plight.

“We are very disappointed, and it gives us the impression that the government has lost touch with the realities on the ground. Our disposable income has been affected; our working capital has been affected. In a situation where businesses are collapsing, the government should have been conscious in introducing measures that would save businesses…it is our prayer parliament won’t approve the budget,” Appiah Kubi said, as quoted by citinewsroom.com.

While presenting the 2023 budget and economic policy, on Thursday, November 24, 2022, on the floor of parliament, Ofori-Atta said that the increment in VAT was part of a seven-point agenda to remedy the country’s prevailing economic crisis.

He added that the government is expecting to rake in rake in GH¢2.70 billion from the VAT which will now become 15% if approved by parliament, to be used for infrastructure development.

“Mr Speaker, the demand for roads has become the cry of many communities in the country. Unfortunately, with the current economic difficulties and the absence of a dedicated source of funding for road construction, it is difficult to meet these demands. In that regard, we are proposing the implementation of new revenue measures. The major one is an increase in the VAT rate by 2.5 percentage points.”

“This will be complemented by a major compliance programme to ensure that we derive the maximum yields from existing revenue handles,” the Finance Minister said.

Aside from the VAT increment, the controversial Electronic Transfers Levy (e-levy) has been reduced from 1.5% to 1%, while the GHC100 exemption for transactions per day has been removed.

If it gets the approval of parliament, it means that any amount – regardless of how small that is transferred electronically from one account to another belonging to a different holder will attract the 1% tax.