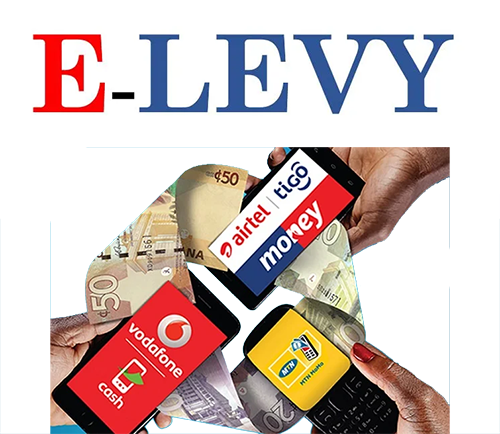

Parliament approves reduction of E-levy rate to 1%, rejects removal of GH₵100 threshold

Parliament has approved an amendment to the Electronic Transaction Levy (E-levy) Act on Wednesday, December 21, 2022.

Government during the presentation of the 2023 Budget announced a reduction of the e-levy rate from 1.5% to 1% and wanted to remove the daily non-taxable threshold of GH₵100.

Government sought to make the levy applicable to any amount transferred electronically.

The Minority subsequently declared their stance to object to the removal of the GH₵100 threshold.

However, the bill when submitted to the House on Wednesday for approval, had excluded the section which sought to remove the GH₵100 threshold.

The 1.5% rate was a downward revision from the initially proposed 1.75%.

Despite the many agitations and rejections of the levy, the government said it was a significant revenue generation tax needed to shore up revenue for the economy.

Several months after the levy was implemented, the government said it could not generate the expected revenue from the levy.

Mobile money transactions between 2017 and 2021 increased from GH¢1.55 billion to GH¢9.86 billion, but the figure has since drastically reduced.